Empower: Advance & Credit

Getting to Know Empower: Advance & Credit

Hey folks! So, I’ve been diving into this app called Empower: Advance & Credit and let me tell you, it’s quite an experience. Imagine having a personal finance assistant right at your fingertips, ready to help you manage your money like a pro. Whether you’re looking to track your spending, save for a rainy day, or even get a cash advance, Empower seems to have it all covered.

Unpacking the Features

First things first, let’s talk about what Empower offers. The app is packed with features that make managing your finances easy and intuitive. One of my favorites is the automatic budgeting tool. You just connect your bank account, and Empower takes over, analyzing your spending habits and categorizing your expenses. It’s like having a personal accountant without the hefty fees!

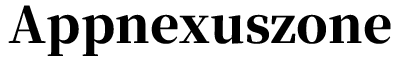

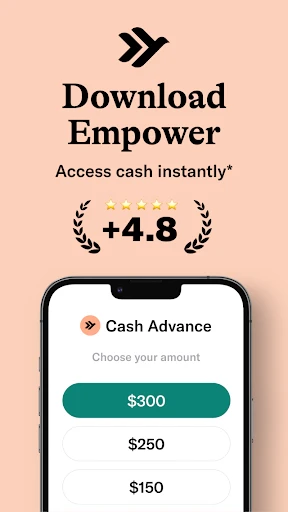

But wait, there’s more! Empower doesn’t just stop at budgeting. It offers cash advances too. We’re talking instant cash, right when you need it, without the pesky credit checks. It’s a lifesaver for those unexpected expenses that pop up out of nowhere.

Saving Made Simple

If you’re someone who struggles with saving, Empower has got your back. The app has a nifty feature called autosave which automatically sets aside money based on your spending patterns. It’s like having a savings jar that fills up without you even noticing! Plus, you can set up specific savings goals and watch your progress in real-time, which is super motivating.

User Experience and Design

Let’s chat about the app’s design. Empower has a clean, user-friendly interface that’s easy to navigate even if you’re not tech-savvy. The layout is intuitive, with all the key features accessible from the main dashboard. And the best part? It’s visually appealing without being overwhelming. The color scheme is easy on the eyes, which makes using the app a pleasant experience.

Security and Support

Now, I know security is a big deal when it comes to financial apps. Empower uses bank-level encryption to keep your data safe, so you can rest easy knowing your information is protected. Plus, they offer excellent customer support. If you ever run into a snag, the support team is just a message away, ready to assist you with any issues.

Final Thoughts

So, what’s the verdict? Empower: Advance & Credit is definitely worth checking out if you’re looking for a comprehensive financial app to help manage your money. It’s easy to use, packed with useful features, and offers excellent security. Whether you need help with budgeting, saving, or just need a quick cash advance, Empower has got you covered. Give it a whirl and see how it can transform your financial habits!

- Developer

- Empower Finance

- Version

- 6.73.0.721

- Installs

- 5,000,000+

- Android Version

- 7.0

- Content Rating

- Everyone

- Price

- Free

- User-friendly interface

- Quick approval process

- Flexible repayment options

- Low interest rates

- Wide network of partners

- Limited to certain regions

- Requires internet access

- May affect credit score

- Potential hidden fees

- Limited customer support hours