PREMIER Credit Card

Have you ever felt like credit cards are just a big mystery? Well, let me tell you about my experience with the PREMIER Credit Card, and maybe I can help clear up some of that confusion. This card is like a little financial helper if you’re looking to build or rebuild your credit history. Let me walk you through what I found when I took it for a spin.

Getting Started with the PREMIER Credit Card

So, the application process for the PREMIER Credit Card was pretty straightforward. I hopped online, filled out some basic info, and clicked submit. The thing I appreciated here was that they don’t just leave you hanging for days on end. I got a response pretty quickly, which is always a plus in my book. The card is designed for those of us with less than stellar credit, and it doesn’t require a great credit score to apply. It’s almost like they’re saying, “Hey, we get it. Let’s start fresh.”

Features That Caught My Eye

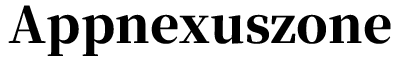

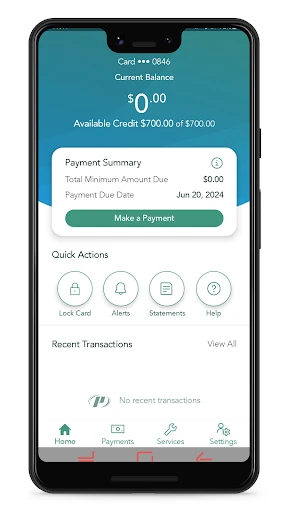

Once you’re approved, you get access to some neat features. For starters, the initial credit limit isn’t massive, but it’s enough to get you going without overwhelming you. This card is more about helping you manage your finances wisely rather than giving you a huge spending spree. I like that it reports to the major credit bureaus, which is crucial for building credit. Plus, they offer a mobile app to help you keep track of your spending and payments. It’s pretty user-friendly, which is something I always look for in financial apps.

Another thing that stands out is their customer service. Whenever I had a question or needed help, they were just a phone call away, and I didn’t have to deal with those annoying automated systems for hours. It’s nice to talk to an actual human sometimes, right?

What’s the Catch?

Of course, like any financial product, it’s not all sunshine and rainbows. The PREMIER Credit Card does come with some fees—like an annual fee and higher-than-average interest rates. But, let’s be real, if you’re using it to build credit, the key is to pay off your balance in full each month. That way, you avoid the interest. Think of it as a stepping stone to better credit products in the future. You just have to be mindful and not let those fees catch you off guard.

Final Thoughts

So, would I recommend the PREMIER Credit Card? If you’re someone who’s trying to build or rebuild credit, then yes, it could be a solid option for you. It’s simple, straightforward, and gives you the tools you need to improve your credit score over time. Just remember, it’s not a free ride. Be smart with how you use it, and it could definitely help you on your financial journey.

In a nutshell, the PREMIER Credit Card is like that friend who’s willing to give you a shot when others might not. Use it wisely, and you’ll be on your way to better credit in no time. Cheers to smart financial decisions!

- Developer

- PREMIER Bankcard

- Version

- 3.16.0

- Installs

- 1,000,000+

- Android Version

- 12

- Content Rating

- Everyone

- Price

- Free

- Easy to track expenses via app

- Convenient mobile payments

- Instant transaction alerts

- No annual fee

- Flexible credit limits

- High interest rates

- Limited international acceptance

- Complex rewards program

- Slow customer service response

- Occasional app glitches