EarnIn: Why Wait for Payday?

If you’ve ever found yourself counting down the days to your next paycheck, hoping to stretch your dollars just a bit further, then EarnIn might just be the app you didn’t know you needed. Let’s dive into how this app can help you make every day feel like payday.

What is EarnIn?

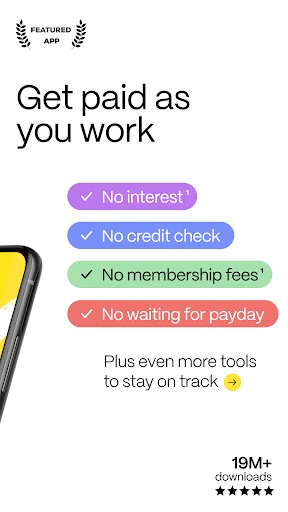

In the world of financial apps, EarnIn stands out with its unique approach to payday advances. Unlike traditional payday loans that come with hefty interest rates, EarnIn offers a more user-friendly solution by letting you access a portion of your earned wages before your official payday. It’s like getting a sneak peek at your paycheck without any strings attached.

Getting Started with Ease

Starting with EarnIn is a breeze. Once you download and install the app on your Android or iOS device, the setup process is pretty straightforward. You’ll need to link your bank account and provide some employment details to prove your income. But no worries, the app ensures all your information is secure and encrypted. What I love about EarnIn is its seamless interface. It’s clean, intuitive, and makes accessing your money feel like a walk in the park.

Features That Make a Difference

One of the standout features of EarnIn is its Cash Out option. Imagine you’re halfway through the month and an unexpected expense pops up – maybe your car decides to take a day off. With EarnIn, you can cash out up to $100 per day, up to $750 per pay period, depending on your earnings. And the best part? No fees or interest rates. They operate on a tip-based system, allowing you to pay what you think is fair, even if it’s nothing at all.

Another nifty feature is the Balance Shield. We’ve all been there – that terrifying moment when your bank balance is dangerously close to zero. Balance Shield sends you notifications when your balance is low and even offers a cash out to prevent overdraft fees. It’s like having a financial guardian angel watching over your account.

Insights and Community

But EarnIn isn’t just about financial transactions; it’s about building a community and offering insights. The app provides a section called Health Aid, where users can access free financial resources and tools to improve their financial well-being. Whether it’s tips on budgeting or finding ways to save, EarnIn goes beyond just a payday advance app.

Moreover, the community aspect is pretty engaging. You can see what others are tipping and even join in on discussions about financial wellness. It’s a platform that encourages users to support one another, making it more than just a transactional app.

Is EarnIn Right for You?

So, who exactly benefits from EarnIn? If you’re someone who occasionally finds yourself in a pinch before payday, this app can be a lifesaver. It’s particularly useful for those who want to avoid the pitfalls of traditional payday loans and their exorbitant fees. Plus, the flexibility of tipping means you’re not forced into paying more than you’re comfortable with.

However, it's worth mentioning that EarnIn isn’t a solution for chronic financial issues. It’s more of a short-term relief option rather than a long-term financial strategy. But for those moments when you need a quick financial boost, it’s a reliable option to have in your back pocket.

In conclusion, EarnIn is like that friend who’s always there to spot you a few bucks when you’re short. It’s user-friendly, community-driven, and refreshingly free of hidden costs. So, if you’re looking to take control of your finances and bridge the gap between paychecks, give EarnIn a try. It might just be the financial sidekick you’ve been searching for.

- Developer

- Activehours Inc.

- Version

- 15.69.1

- Installs

- 5,000,000+

- Android Version

- 8.0

- Content Rating

- Everyone

- Price

- Free

- Instant access to earned wages.

- No interest or hidden fees.

- Helps avoid payday loans.

- Easy-to-use interface.

- Supports financial planning.

- Requires access to bank account.

- Limited to certain employers.

- May encourage spending.

- Potential privacy concerns.

- Not a substitute for savings.