Atlas - Rewards Credit Card

Unlocking Rewards with Atlas - Rewards Credit Card

Hey there, savvy spenders! If you’re on the hunt for a credit card that not only helps you manage your finances but also rewards you every step of the way, then let me introduce you to the Atlas - Rewards Credit Card. I’ve taken this card for a spin, and I’m here to spill the tea on why it might just be the perfect addition to your wallet.

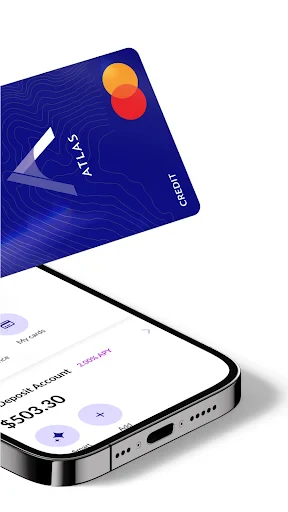

Getting Started with Atlas

First things first, applying for the Atlas - Rewards Credit Card is a breeze. The user-friendly app guides you through each step with ease. I was pleasantly surprised by how quickly I got approved, and before I knew it, the card was in my hands, ready for action. The app itself is sleek and intuitive, making it super simple to track spending, pay bills, and check out the awesome rewards you’re racking up.

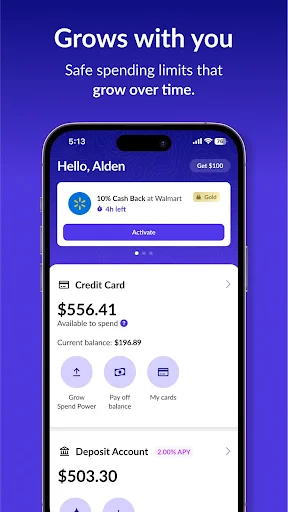

Rewarding Every Purchase

Let’s dive into the juicy part – the rewards. With every swipe, tap, or online purchase, you’re earning points. Whether it’s groceries, dining out, or booking a flight, Atlas has got your back. What I love most is the flexibility; you can redeem points for travel, gift cards, or even cash back. I recently booked a weekend getaway using my points, and it felt like a free vacation – who doesn’t love that?

Security and Peace of Mind

In today’s digital age, security is key, and Atlas doesn’t skimp on that front. The app features advanced security measures, including fingerprint authentication and real-time alerts for any suspicious activity. It gives me peace of mind knowing that my information is safe and sound. Plus, the customer support is always just a tap away if you need any assistance.

Making the Most of It

Now, here’s a little tip from me to you: maximize those reward points by keeping an eye on the rotating bonus categories. Atlas offers extra points on select categories each month – think dining, travel, or groceries – so plan your spending accordingly to squeeze the most out of your card. And don’t forget to pay off your balance in full each month to avoid those pesky interest charges.

Final Thoughts

Overall, the Atlas - Rewards Credit Card is a fantastic choice for anyone looking to earn rewards while managing their finances with ease. From the smooth application process to the robust security features, it’s a card designed with the user in mind. The rewards are the cherry on top, making everyday purchases feel like a win.

If you’re ready to take your spending to the next level and enjoy a host of benefits along the way, give Atlas a try. It might just be the financial companion you’ve been searching for. Happy spending!

- Developer

- Exto Inc.

- Version

- 3.5.8

- Installs

- 1,000,000+

- Android Version

- 7.1

- Content Rating

- Everyone

- Price

- Free

- Easy application process

- No annual fees

- Cashback on all purchases

- Flexible payment options

- Wide acceptance

- High APR

- Limited rewards categories

- No signup bonus

- Foreign transaction fees

- Strict credit requirements