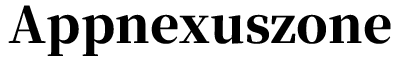

Chime – Mobile Banking

If you’re anything like me, balancing a checkbook is about as exciting as watching paint dry. Enter Chime – Mobile Banking, a game-changer in the world of digital finance that promises to make managing money not just easy, but dare I say, enjoyable. I’ve spent some quality time with this app, and here’s my no-holds-barred take on it.

Getting Started with Chime

Signing up for Chime is as breezy as a Sunday morning. You’ll need to download the app from either the Google Play Store or the Apple App Store, and then it’s just a matter of entering some basic details. The app’s smooth interface guides you effortlessly through setting up your account. Within minutes, I was exploring what Chime had to offer.

Features That Make You Go "Wow"

One of the first things that stood out to me was the lack of fees. That’s right, folks—no monthly fees, no minimum balance requirements, and no foreign transaction fees. It’s like a breath of fresh air in a world where banks seem to nickel and dime you at every turn. Plus, with access to over 60,000 fee-free ATMs, you’re never far from your cash.

The automatic savings feature is another highlight. By rounding up your purchases to the nearest dollar and depositing the difference into your savings account, Chime makes saving money feel less like a chore and more like a natural part of spending. I also loved the early direct deposit feature, which lets you access your paycheck up to two days early. Who doesn’t want to get paid sooner?

Security You Can Trust

When it comes to my hard-earned cash, security is non-negotiable. Thankfully, Chime gets this. The app uses robust security measures, including two-factor authentication, to keep your information safe. I found peace of mind in knowing that my data was protected by encryption and that I could instantly block my card from within the app if it was ever lost or stolen.

User Experience: Smooth Sailing

I’ve got to hand it to Chime; they’ve really nailed the user experience. The app is intuitive, with a clean design that makes navigation a breeze. Whether you’re checking your balance, transferring funds, or paying bills, everything is just a tap away. I never once felt overwhelmed or confused, which is more than I can say for some other banking apps I’ve tried.

Final Thoughts

To sum it all up, Chime – Mobile Banking is a solid option for anyone looking to simplify their financial life. It’s particularly great for those of us who appreciate convenience, transparency, and a no-fee approach to banking. Sure, it doesn’t have all the bells and whistles of a traditional bank, like in-branch services or loans, but what it lacks in extras, it more than makes up for in ease of use and peace of mind.

If you’re ready to ditch the fees and embrace a more seamless way to manage your money, give Chime a try. You might just find that banking doesn’t have to be a necessary evil—it can actually be a pleasant part of your everyday routine.

- Developer

- Chime

- Version

- 5.275.0

- Installs

- 10,000,000+

- Android Version

- 10

- Content Rating

- Everyone

- Price

- Free

- No monthly fees or minimum balance requirements.

- Instant notifications for transactions.

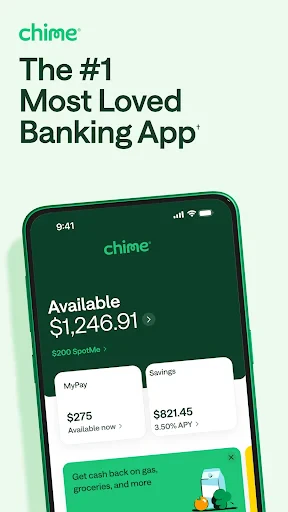

- Fee-free overdraft up to $200.

- Access to 60

- 000+ free ATMs.

- No physical branches available.

- Cash deposit fees at certain locations.

- Limited customer service availability.

- No joint account options.

- Requires smartphone for full functionality.