Root: Better car insurance

Picture this: you’re driving along, windows down, favorite tunes blaring, when BAM—out of nowhere, you need to file an insurance claim. Now, if you’re like me, the thought of dealing with car insurance is about as appealing as a root canal. Enter Root: Better car insurance, an app promising to revolutionize how we think about car insurance. Let's dive into what makes this app stand out from the crowd.

Driving Your Way to Savings

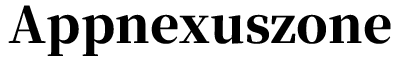

The premise of Root: Better car insurance is simple yet genius—your driving determines your rate. Gone are the days of being lumped into broad categories with everyone else. Instead, Root uses the magic of technology to offer personalized rates based on how you actually drive. It’s like having a personal insurance genie in your pocket!

Now, here’s how it works: you download the app, and it tracks your driving habits over a few weeks. Things like braking, speed, and even the time of day you’re on the road are all taken into account. It might feel a bit like having a backseat driver at first, but trust me, it’s well worth it. Once the app has enough data, it calculates your personalized rate. The better you drive, the more you save—simple as that.

User-Friendly Experience

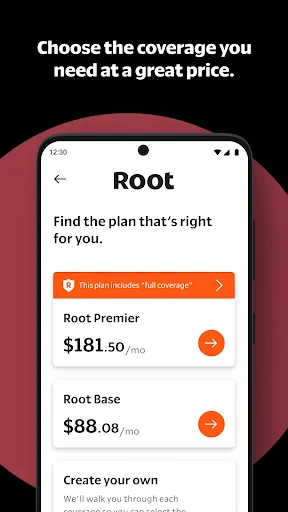

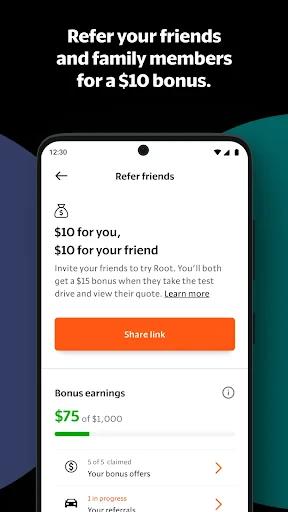

One of the things I love about this app is its user-friendly interface. Setting it up is a breeze, and the minimalistic design means you won’t get lost in a sea of menus. Plus, everything is neatly organized, so whether you’re filing a claim or checking your rate, it’s all just a tap away.

Another neat feature is the ability to manage everything right from the app. Need to update your policy or add a new vehicle? No problem. Root makes it as easy as pie, allowing you to handle all your insurance needs without ever having to call an agent. And let’s be honest, who really wants to sit on hold listening to elevator music?

Transparency and Trust

Insurance can often feel like an enigma wrapped in a riddle, but Root is all about transparency. You can see exactly how your driving affects your rate, which means no more guessing games. It’s refreshing to know what you’re getting and why you’re getting it. Plus, if you ever need a helping hand, their customer service is top-notch—responsive, friendly, and genuinely helpful.

Another bonus is the app’s commitment to fairness. By basing rates on your actual driving, Root levels the playing field. It’s a win-win for good drivers who’ve been paying more than their fair share.

Final Thoughts

All in all, Root: Better car insurance is a game-changer in the insurance world. It’s a breath of fresh air in an industry that’s notorious for being anything but. If you’re looking for a way to potentially lower your car insurance rates while enjoying a seamless, user-friendly experience, Root might just be the app for you. Drive safe, and watch as those savings roll in!

- Developer

- Root, Inc

- Version

- 326.0.0

- Installs

- 1,000,000+

- Android Version

- 5.0

- Content Rating

- Everyone

- Price

- Free

- Easy to use interface

- Quick claims processing

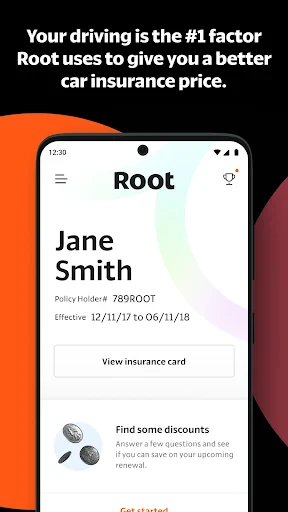

- Affordable premium rates

- Customizable coverage options

- Excellent customer support

- Limited to certain regions

- No online chat support

- Occasional app crashes

- Limited policy options

- No multi-language support