Robinhood - FinTech SuperApp

Alright folks, let's chat about an app that's been buzzing around the investment world like a caffeinated bee – Robinhood: Investing for All. If you're like me, you've probably heard the chatter: "Is it really that good? Can I trust it with my hard-earned cash?" Well, I've taken the plunge, and here's my take on it.

Getting Started: A Walk in the Park

First things first, setting up on Robinhood is as smooth as a jazz sax solo. You download the app, sign up, and bam! You're in. What I really love about Robinhood is its no-fuss interface. It's clean, intuitive, and doesn't feel like you're trying to decode the matrix. Whether you're a seasoned investor or a newbie, navigating through the app is a breeze. It almost feels like the app is holding your hand through the process, which is comforting when you're dealing with something as serious as investing.

The Features: More Than Just a Pretty Face

Now, onto the meat of the app – its features. Robinhood offers commission-free trading for stocks, options, ETFs, and even cryptocurrencies. Yes, you heard that right, no commission fees, which means more money stays in your pocket. The app also provides real-time market data and news, so you're always in the loop with what's happening in the financial world.

One feature that caught my eye is the fractional shares option. This means you can buy a fraction of a share if you can't afford the whole thing. It's perfect for those who want to invest in big companies like Apple or Amazon without breaking the bank. Also, the recurring investment feature is a lifesaver for those who want to invest consistently without the hassle.

User Experience: As Easy as Pie

Using Robinhood feels like a breath of fresh air in the often stifling world of finance. The design is minimalistic, which I appreciate because the last thing I want is to feel overwhelmed by charts and graphs. The app is also pretty quick, with trades executing swiftly, which is crucial when the market's moving fast.

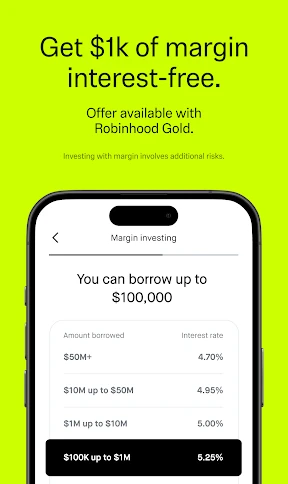

And let's not forget about the Robinhood Gold subscription. For a monthly fee, you get access to professional research reports, bigger instant deposits, and margin trading. It's a nice touch for those looking to step up their game.

The Learning Curve: Not Too Steep

If you're worried about the learning curve, don't be. Robinhood offers a plethora of resources to get you up to speed. Their in-app learning materials and blog are top-notch, perfect for brushing up on your investing skills. Plus, the community aspect where users share insights and strategies is a goldmine for learning the ropes.

Final Thoughts: Worth the Hype?

So, is Robinhood worth the hype? In my humble opinion, yes. It's democratized investing, making it accessible and straightforward for everyone. While it may not have all the bells and whistles of a full-service brokerage, it more than makes up for it with its simplicity, affordability, and ease of use. Whether you're looking to dip your toes into investing or you're a seasoned trader, Robinhood is a solid choice for managing your investments.

So, if you're ready to take control of your financial future, give Robinhood a whirl. Who knows, you might just find yourself enjoying the ride!

- Developer

- Robinhood

- Version

- 2025.20.2

- Installs

- 10,000,000+

- Android Version

- 7.0

- Content Rating

- Everyone

- Price

- Free

- User-friendly interface for easy navigation.

- Commission-free trades for stocks and ETFs.

- Access to cryptocurrency trading.

- Instant deposits enhance trading speed.

- Educational resources for beginners.

- Limited research tools for advanced traders.

- Customer support can be slow at times.

- No retirement accounts available.

- Frequent app outages reported by users.

- Cash management features are limited.