Current: The Future of Banking

Hey there! Let me take you through an app that's been making waves in the digital banking sphere: Current. Now, if you're someone like me who loves the idea of managing finances with just a few taps, this one's worth your attention.

Breaking Down the Basics

First off, Current is not just your typical banking app. It's positioned itself as a forward-thinking financial tool, promising a fresh look at how we handle our money. With a sleek interface and a user-friendly design, it's clear from the get-go that Current is designed with the modern user in mind.

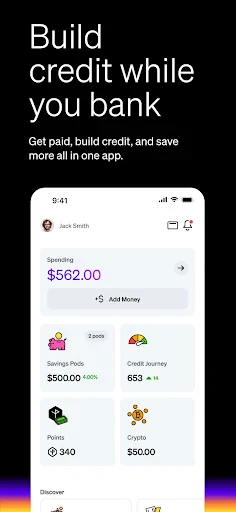

One of the standout features is its ability to offer faster access to your funds. We're talking getting your paycheck up to two days early, which can be a game-changer if you're living paycheck to paycheck or just need that extra cash flow sooner.

Features That Make a Difference

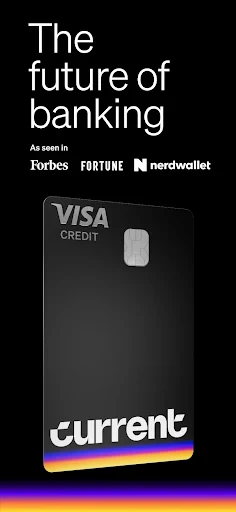

Current's features are tailored for a tech-savvy audience. You get real-time notifications about your spending, which is great for those of us who tend to lose track of our expenses. Plus, the app offers spending insights, helping you to budget better and understand your spending habits.

The app also comes with savings pods, a nifty little tool that lets you set aside money for specific goals. Whether you're saving for a trip, a gadget, or just a rainy day fund, these pods make it easy to allocate funds without the hassle of opening multiple accounts.

Banking Made Social

One of the unique aspects of Current is its social banking feature. It allows you to easily send and receive money from friends and family. It's like having a Venmo integrated into your bank account, which is pretty cool if you ask me. No more awkward conversations about who owes what at dinner!

Moreover, Current offers a rewards system. You earn points on purchases which can later be redeemed for cash back. It's a little perk that adds up over time, making your spending work for you.

Security and Peace of Mind

Now, I know what you're thinking: with all these features, how safe is my money? Current has got you covered with robust security measures, including encryption and instant card locking features. It's always reassuring to know that you can lock your card right from your phone if it goes missing.

Plus, Current is FDIC-insured, meaning your money is just as safe as it would be in any traditional bank. So, you can breathe easy knowing your funds are protected.

Another cool feature is the ability to deposit checks through the app. Just snap a photo, and voila, it's in your account. It's little conveniences like these that make Current stand out from the crowd.

Final Thoughts

In conclusion, Current is shaking up the banking world with its innovative features and user-centric approach. Whether you're looking for faster access to your money, better budgeting tools, or just a more modern banking experience, Current delivers on all fronts.

It's easy to see why so many people are making the switch. With its combination of convenience, security, and rewards, it's redefining what we expect from a bank. If you haven't checked it out yet, I'd say it's definitely worth giving it a shot. Happy banking!

- Developer

- Current

- Version

- 7.28.1

- Installs

- 5,000,000+

- Android Version

- 8.0

- Content Rating

- Everyone

- Price

- Free

- User-friendly interface with intuitive navigation.

- Real-time transaction notifications.

- Offers budgeting and savings tools.

- No hidden fees

- fully transparent.

- Limited customer service availability.

- Requires stable internet connection.

- Not all features available in all regions.

- Occasional app glitches reported.

- Limited integration with other apps.