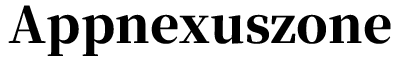

Netspend Wallet

Let’s dive into the world of the Netspend Wallet, a handy tool for managing your finances in this digital age. It's like having a bank in your pocket, and trust me, it's super convenient! I've been giving this app a whirl, and here's the lowdown on what you can expect when using it.

Getting Started with Netspend Wallet

First off, let’s talk about setting up the Netspend Wallet. Downloading the app is a breeze, available on both Android and iOS platforms. Once you’ve got it installed, you’ll be guided through a straightforward setup process. It’s all about entering some basic info to create your account. If you’re like me and dread complicated setups, rest easy—this one’s painless.

Features That Stand Out

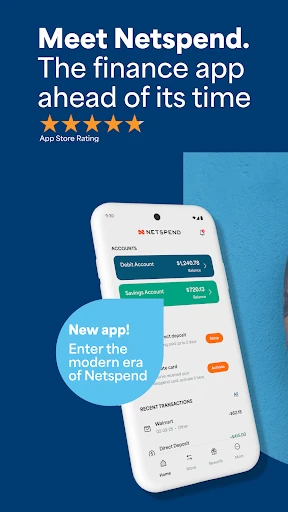

Now, let's get into the meat of the app. One feature I absolutely love is the real-time notifications. Every time money is spent or received, you'll get an alert. This is fantastic for keeping tabs on your spending. Plus, the budgeting tools are genuinely helpful. You can set spending limits, and the app will nudge you if you’re getting close. It’s like having a financial advisor on your phone!

Another cool feature is the ability to add checks via your phone's camera. It’s as simple as snapping a picture. No more trips to the bank! Also, sending money to friends and family is as easy as pie. You just need their email or phone number, and voilà, you’re done.

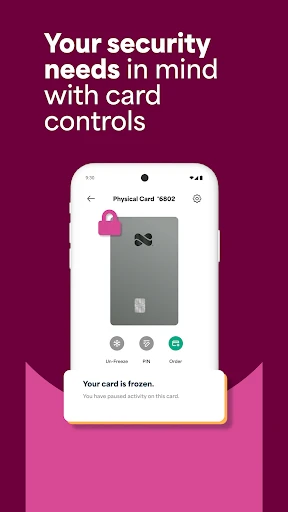

Security and Trust

When it comes to handling money, security is key. The app uses encryption, which means your data is safe and sound. I felt pretty confident using it, knowing my personal information is locked down. Plus, if you lose your phone, you can quickly disable the app from another device.

User Experience

Overall, the design is intuitive. Everything is where you expect it to be, and the user interface is clean and uncluttered. Navigating through the app is smooth, and I didn’t experience any lag or hiccups. Whether you’re checking your balance, transferring funds, or managing your budget, it’s all straightforward.

I also appreciate the customer support options. Live chat, email, or phone support are available if you run into any issues. I tried the live chat feature, and the response was quick and helpful. It’s reassuring to know help is easily accessible if needed.

Final Thoughts

Wrapping it up, the Netspend Wallet is a solid choice for anyone looking to manage their finances digitally. With its user-friendly interface, robust features, and strong security measures, it’s a reliable app that makes handling money a whole lot easier. If you’re on the hunt for a digital wallet that does it all, give this one a try. You might just find it’s exactly what you need to streamline your financial life.

- Developer

- NetSpend

- Version

- 2.0.1

- Installs

- 500,000+

- Android Version

- 9

- Content Rating

- Everyone

- Price

- Free

- User-friendly interface and easy navigation.

- Offers customizable budgeting tools.

- Supports mobile check deposit feature.

- Provides real-time transaction alerts.

- No credit check required to open an account.

- Limited ATM network for free withdrawals.

- Monthly fee if direct deposit is not set up.

- Customer service can be slow at times.

- No interest earned on account balance.

- Limited features compared to traditional banks.