ONE@Work (formerly Even)

Ever found yourself in a situation where payday seems like an eternity away, and your funds are running low? Enter ONE@Work (formerly Even), a financial app designed to help you manage those mid-month money blues. This app isn't just about cash advances; it's a holistic tool aiming to reshape the way you handle your finances.

What Sets ONE@Work Apart?

When I first stumbled upon ONE@Work, I was intrigued by its promise of financial wellness. Unlike typical payday loan apps, this one offers a unique blend of features. Its primary draw is the ability to access earned wages before payday, but there's so much more under the hood.

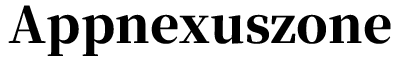

The app integrates seamlessly with your work's payroll systems, allowing you to see how much you've earned in real-time. This transparency is incredibly empowering as it puts you in control of your financial health. No more guessing games about your earnings!

Features That Make a Difference

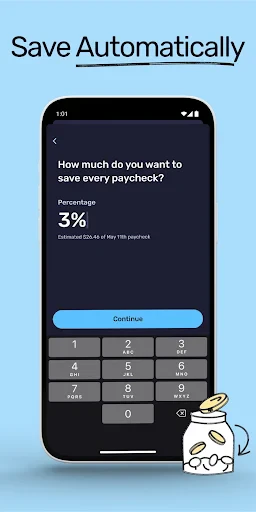

One feature that immediately caught my eye is the budgeting tool. Instead of simply giving you access to your wages, it encourages smart spending. The app provides a snapshot of your financial landscape, breaking down your spending habits. This feature is like having your own financial advisor on your phone 24/7.

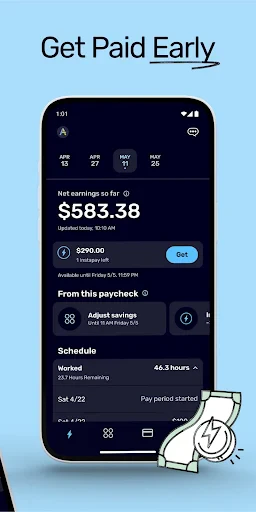

Moreover, ONE@Work offers an automatic savings option. As someone who's struggled with saving consistently, this feature is a game-changer. You can set aside a portion of your earnings automatically, ensuring that your savings grow without you even noticing.

And let's not forget the cash advance feature. Unlike traditional payday loans that come with hefty interest rates, ONE@Work offers this service with minimal fees, making it a much more affordable option in times of need.

Experience and Usability

I found the app pretty straightforward to navigate. The user interface is clean and intuitive, ensuring that even those who aren't tech-savvy won't have a hard time getting the hang of it. From signing up to linking your payroll, the process is seamless.

Customer support is another area where ONE@Work shines. Any questions I had were promptly answered by their support team, making the overall experience quite pleasant. It's evident that they value customer satisfaction.

Final Thoughts

Overall, ONE@Work is more than just a financial app; it's like having a personal finance assistant in your pocket. It offers a suite of tools that not only provide immediate financial relief but also promote long-term financial health. If you're looking to take charge of your financial future, this app is certainly worth a shot. Plus, with its focus on transparency and affordability, it's a breath of fresh air in the world of financial apps.

In a nutshell, whether you're living paycheck to paycheck or just looking for a better way to manage your money, ONE@Work has got your back. It's time to say goodbye to those financial worries and embrace a more secure financial future.

- Developer

- ONE Finance, Inc.

- Version

- 10.87.6

- Installs

- 1,000,000+

- Android Version

- 5.0

- Content Rating

- Everyone

- Price

- Free

- Simplifies financial planning.

- Real-time pay access.

- User-friendly interface.

- Secure data handling.

- Integrates with payroll systems.

- Limited features for freelancers.

- Subscription fee required.

- Occasional app crashes.

- Limited customer support.

- Only available in certain regions.